By Matt Baker, Co-owner/REALTOR of Baker Realty

When purchasing a home with a loan, the lender (bank) will want an appraisal on the home. The lender does this because they don’t want to lend more money than the house is worth or valued. This is to protect the lender. If the buyer defaults on their payments, the bank needs to be able to sell the home and recover the loan value.

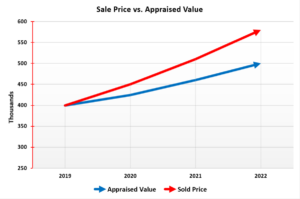

In the Central Texas market, we are in what many would define as a hyper-inflated real estate market. We are seeing incredible offer prices from buyers, and this is due to many factors including

• low inventory (more buyers than sellers),

• incredible economic growth with many businesses moving to the area, and

• general demand for living in Central Texas due to low unemployment, low cost of living (compared to many large cities), great lakes, many new and modern conveniences, etc.

When you’re in a hyper-inflated market, prices are increasing at a very quick rate. Some areas have seen increases over 50% in one year. And because of the frenzy due to an inventory shortage, you might even see offers 20% over the previous record set just the previous month.

In these cases, it is common for the appraisal to not be as high as the offer price, even though the appraisal should reflect current market value. This difference (or gap) can be caused by several factors such as:

• The comparable homes used by the appraiser don’t represent the market today,

• The appraiser believes the market value is a seller’s bubble and does not reflect the true market value of the home, and

• Not all appraisers are the same. We have witnessed two different appraisals on the same home, 2 weeks apart, that were different by $100,000.

Because of this, most sellers will not accept a contract unless the buyer is willing to make up the difference between the appraisal and the contract price. This means not only will the buyer need the cash for a down payment and closing fees, but they will also need to cover the appraisal gap.

Let’s look at two examples.

Example 1

House listed for $350,000

Winning Bid: $400,000

Appraisal returns at $375,000

If buyer was planning on putting 10% down, the buyer would need a total of $65,000 in cash ($40,000 down payment, $25,000 to buy-down the appraisal) PLUS any closing expenses (lender fees, title fees, inspection, etc), which can amount to $6,000-$12,000 or more, depending on various factors.

Example 2

House listed for $500,000

Winning Bod: $600,000

Appraisal returns at $550,000

If buyer was planning on putting 20% down, the buyer would need a total of $170,000 in cash ($120,000 down payment, $50,000 to buy-down the appraisal) PLUS any closing expenses (lender fees, title fees, inspection, etc).

Side Note

There are other ways to make offers more successful than just offer price. We are now witnessing most successful offers where the buyer pays for a new survey if required, covers the title policy, and pays for all the HOA transfer fees and forgoes a home warranty. Traditionally these have been seller expenses.

Where is the good news? Well, if the market continues the same path, a buyer will recoup their value very quickly. For example, if a buyer pays $550,000 for a $500,000 house, with a 10% annual market increase you’re breaking even in 12 months. We have seen buyers gain $100,000 in value in 12 months and be ahead of their purchase price in as little as 6 months.

If you need experienced professional advice on how to navigate this seller’s market, please contact us for assistance.